| This is the

talk page for discussing improvements to the

Gold as an investment article. This is not a forum for general discussion of the article's subject. |

Article policies

|

| Find sources: Google ( books · news · scholar · free images · WP refs) · FENS · JSTOR · TWL |

| Archives: 1, 2, 3 |

| Gold as an investment was a Social sciences and society good articles nominee, but did not meet the good article criteria at the time. There may be suggestions below for improving the article. Once these issues have been addressed, the article can be renominated. Editors may also seek a reassessment of the decision if they believe there was a mistake. | |||||||||

| ||||||||||

|

| This article is rated B-class on Wikipedia's

content assessment scale. It is of interest to the following WikiProjects: | ||||||||||||||||||||

| |||||||||||||||||||||

|

|

Daily pageviews of this article

A graph should have been displayed here but

graphs are temporarily disabled. Until they are enabled again, visit the interactive graph at

pageviews.wmcloud.org |

| It is requested that a template-based chart or charts be

included in this article to

improve its quality. Useful templates may be found in

Category:Chart, diagram and graph formatting and function templates. Specific illustrations, plots or diagrams can be requested at the

Graphic Lab. For more information, refer to discussion on this page and/or the listing at Wikipedia:Requested images. |

![]() This article is or was the subject of a Wiki Education Foundation-supported course assignment. Further details are available

on the course page. Student editor(s):

Bandit039. Peer reviewers:

Peng.po,

Tambisagar,

Zestywalrus.

This article is or was the subject of a Wiki Education Foundation-supported course assignment. Further details are available

on the course page. Student editor(s):

Bandit039. Peer reviewers:

Peng.po,

Tambisagar,

Zestywalrus.

Above undated message substituted from Template:Dashboard.wikiedu.org assignment by PrimeBOT ( talk) 22:30, 16 January 2022 (UTC)

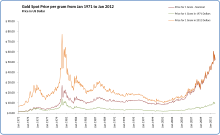

The chart does not - at least at first glance - seem biased. The site that is promoted via a URL inside the image that shows it, does, though. I wonder whether it might be a good idea to replace that chart with a similar one that does not contain any kind of external link or advertisement.

And yes, I am a native German speaker, so I think I can tell the linked site's flavor. It most certainly does not seem to be a pure archive of charts and data that may claim to be free of any obvious opinion :-)

Sbohmann ( talk) 20:53, 15 June 2010 (UTC)

The M3 is still tracked at M3b here:

It currently is as 13.2 Trillion for the month of March, 2008. mickrussom ( talk) 21:37, 18 March 2008 (UTC)

This article seems better than "start" grade to me. Prestonp 15:13, 5 November 2007 (UTC)

- I noticed the good article tag on the talk page (only), with only a single line as justification. Also it looks like the reviewer has been extensively involved in writing the article. Writing and reviewing the same article should be avoided. Please let me know if I've misinterpreted this, otherwise I'll probably list it at WP:GAR. Please also see WP:WIAGA. My concern is that it looks somewhat POV Thanks, Smallbones 16:39, 12 November 2007 (UTC)

- I'd be happy to discuss the article with you and make whatever changes were deemed necessary. I don't really understand the NPOV criticism. The article seems relatively straight forward and points out that stocks outperform gold bullion in the United States over a significantly long time frame, which was my addition, BTW. Prestonp 19:02, 12 November 2007 (UTC)

- "Somewhat POV" - is better than a lot of finance articles. The section "Factors that affect Gold price" - looks like a list of everything that makes gold go up. One of the links looks like a Gold Bug website with a page dedicated specifically to wikipedia readers. The formatting, with links to more specific articles, but without much text in this article. This is just off the top of my head, but I'm sure that somebody going methodically through the GA criteria - as it is usually done - would find these and more problems. My concern is maintaining the usual (if informal) GA process. Smallbones 21:16, 12 November 2007 (UTC)

- I hadn't really concerned myself much with the "factors" section of the page, but it seems reasonable enough. As it says in that section, gold's given price is more related to hoarding and dishoarding than other asset classes. I'll go ahead and change the interest rate section to be more general. As for the links, that's another area I don't have much to do with, and I'm sure there are some inappropriate links in there. I changed it from start because, according to wiki's quality scale, it seems clearly beyond the "start" designation. Who would be involved in a more formal review? Prestonp 21:44, 12 November 2007 (UTC)

- I nominated this article under economics at Wikipedia:Good article nominations and changed the grade here to "B" Smallbones 02:53, 13 November 2007 (UTC)

Maucapital 17:26, 6 September 2007 (UTC)

Refactored many of disjoint external links to a single page which includes the current and historical charts. I may include the 30yr chart soon too.

InsideGold 17:46, 18 October 2007 (UTC)

- I added the 30 year chart now as well.

( InsideGold 16:38, 19 October 2007 (UTC))

- I added the currency conversion information and different units of measure to remove the need for the duplicate external link.

( InsideGold ( talk) 19:25, 16 January 2008 (UTC))

- Is it a conflict of interest that User:InsideGold is the administrator of the site that the article now links to? It doesn't appear to be a commercial site, but I think it is worth asking this.-- Eloil ( talk) 15:55, 11 October 2008 (UTC)

Would it be appropriate to add a "Conspiracy Theory" section to this page to reference the efforts of [ GATA]?

( InsideGold 17:55, 18 October 2007 (UTC))

- I think it would be a good addition because you can't really delve too far into the discussion without the topic of central bank selling coming up. The price of gold on the market today would be very different if it weren't for central bank selling, so they are THE major player on the world market. But they have been net sellers year after year, so they're engaging in unsustainable behavior and that leads to speculation as to why. Prestonp 18:03, 18 October 2007 (UTC)

- Thanks. I made an initial addition. Please review and change as required. I tried to keep it short and let the linked page do the majority of the explaining. ( InsideGold 18:29, 18 October 2007 (UTC))

- I can add a section debunking the "naked short" conspiracy if that is warranted. Gold good ( talk) 20:17, 22 February 2023 (UTC)

Should we start a section that talks about the potential gains/risks with Junior Gold Mining companies? Is this the best page for it?

( InsideGold 18:34, 19 October 2007 (UTC))

- No, I think Methods of investing in gold is the correct page for that. Prestonp 05:00, 20 October 2007 (UTC)

- Yeah ... agreed. I'll take a first stab at it and let me know what you think. Stay tuned. ( InsideGold 13:04, 20 October 2007 (UTC))

I would have thought these days that there might be a significant connection between gold prices and oil costs. Or is that wrong? Is there some reason why the word "oil" has never been mentioned in connection with this topic -- Geronimo20 00:08, 12 November 2007 (UTC)

- Oil price is strongly correlated with dollar index. The sentence in the article "Today, like all investments and commodities, the price of gold is ultimately driven by supply and demand," is not correct. Oil is a commodity that is largely determined by dollar index. If gold correlates with oil, then gold correlates with USD index. FrankSz ( talk) 20:58, 16 December 2008 (UTC)

- Oh dear, weird article this. Surely peak oil is the underlying driver of current gold prices. Still no mention! Oh well, weird weird article this. Should it be nominated for deletion on the grounds that it doesn't address it's core issue? :) -- Geronimo20 ( talk) 04:40, 14 March 2008 (UTC)

- I'm not sure that I can agree that Peak Oil is a reason to invest in gold. Peak Oil is a reason to invest in oil/energy not gold. Let's accept Peak Oil is happening then why would gold go up faster than oil or even as fast as oil in this case? Better to invest in oil, alternative energy, natgas, coal, corn, sugar, energy ETFs etc than gold. Most gold that has been mined still exists in a refined form ready to use, so it is perhaps one of the worst commodities to invest in if Peak Oil is here. Moreover this especially applies to gold mining companies that incur energy costs as a major expense in their operations. Additionally consider Peter Schiff whose 'Crash Proof' book I've linked to. Peter Schiff doesn't seem to believe in Peak Oil but has been investing in gold because he believes the money supply has been massively and irresponsibly increased due to artificially low interest rates by central banks, esp the fed. Having said all this I have nothing against mentioning Peak Oil as a factor for increasing gold prices, and even agree that this is the case. Maybe something like 'Peak Oil, if cheap supplies of oil are running out then there will be a general increase in the price of commodities.'. But (and this is a subtle but important point) I disagree that it is a reason to invest in gold. ICouldBeWrong ( talk) 04:09, 19 July 2008 (UTC)

- On the other hand looking at global production stats http://www.kitco.com/ind/Wiegand/jan112007.html it seems that the most recent peak in global gold production was in 2000, (I don't have more recent figures but I very much doubt a new high was reached sinc jan 2007). Whereas global crude oil production reach new highs just months ago (sorry no link just from memory from reading the oil drum). Peak Gold is possibly bullish for gold. Another bullish factor for gold is 'The bias' physical gold appears to be trading for an increasing premium over the front month gold futures contract. 114.73.22.244 ( talk) 04:53, 27 September 2008 (UTC)

GA review – see WP:WIAGA for criteria

- Is it reasonably well written?

- A. Prose quality:

- B.

MoS compliance:

- A. Prose quality:

- Is it factually accurate and

verifiable?

- A. References to sources:

- B. Citation of reliable sources where necessary:

- C.

No original research:

- A. References to sources:

- Is it broad in its coverage?

- A. Major aspects:

- B. Focused:

- A. Major aspects:

- Is it

neutral?

- Fair representation without bias:

- Fair representation without bias:

- Is it stable?

- No edit wars, etc:

- No edit wars, etc:

- Does it contain

images to illustrate the topic?

- A. Images are copyright tagged, and non-free images have

fair use rationales:

- B. Images are provided where possible and appropriate, with

suitable captions:

- A. Images are copyright tagged, and non-free images have

fair use rationales:

- Overall:

- Pass or Fail:

- Pass or Fail:

1:

- Small grammar issues. I’ve fixed what stood out.

- Numerous MoS violations. Some examples:

- Inadequate lead - per WP:LEAD, “The lead should be capable of standing alone as a concise overview of the article, establishing context, summarizing the most important points, explaining why the subject is interesting or notable, and briefly describing its notable controversies, if there are any.”

- Use of weasel words, e.g. “Some investors consider…”, “Others point out…”, etc.

2:

- Numerous additional citations are needed; I’ve tried to mark the ones that stand out. I suspect some of them to be WP:NOR.

- Some references that are already there should be better labeled (i.e. references 8 and 11).

- Article contains several factual inaccuracies (e.g. “Paper currencies pose [sic] a risk of being inflated” is a misleading statement. A true/better statement would be, “Fiat currencies posses a risk of being inflated.”) Another example is “…governments have been free to print as much money as they choose, without fear that their populations will come knocking on the central bank's door demanding to change their paper money back into gold.” This is not an appropriate or factual description of the consequences/results of the collapse of Bretton Woods system.

- Number of suspected WP:NOR violations, e.g. “The above numbers show the falling influence of gold in today's monetary system.” The “Gold's value versus money supply” section needs substantial attention.

3:

- The “Types of gold investor” section is only a link to another article and “Methods of investing in gold” contains only one sentence in addition to a link. These sections should contain enough prose to reasonably summarize the more detailed articles.

- The addition of a section addressing the historical utilizion of gold as an investment and any pertinent reasons therefore would strengthen the article (after all, the article currently says, “Gold has a long history of being an inflation proof investment” – let’s hear about that history.)

- There are issues with redundancy and disorganization which hurt the focus. Money supply and demand numbers are scattered throughout the article (e.g. the “factors” section has “demand” and “supply and demand” subsections, there are demand and supply numbers in the “fundamental analysis” section of “investment strategies” and there is a minimal “supply” section.) Try to combine these into an organized and succinct discussion.

4:

- The article has an inconsistent viewpoint. It is, at times, too US-centric (e.g. the “Gold price” chart contains US farm wages and US government debt, but no “foreign” data). It is, at other times, international, as it addresses the central banks of several countries and, in ironic contrast to the US-centric parts, uses the Queen’s English (e.g. organisations). At other times, it is imprecise (e.g. CPI is mentioned in “factors influencing the gold price”, but it is not known what country’s CPI it is {although, one assumes U.S.) The article should be corrected to exhibit a country-neutral viewpoint (as much is possible given the global influence of the US dollar).

- Some phrases border on WP:NPOV violations (e.g. saying gold is a “safe haven”; the article should let facts reflect the suitability of gold as an investment.)

6:

- The images of the bowl, money as "firewood" and the dinar do not appear appropriate for the topic, which may be an appearance exacerbated by the lack of captions explicitly relating the images to gold as an investment. New captions may remedy this, although I suspect the bowl and dinar, in particular, don't belong.

General: Frankly, the article needs a fair amount of work. I'm happy to help if you need more examples of issues or other assistance. Ɛƚƈơƅƅơƚɑ talk 22:16, 17 November 2007 (UTC)

"Inflation 1923-24: A woman in Germany feeds her tiled stove with money. The money was worth less than firewood." I think it is hiper inflation. kızılsungur 19:17, 24 November 2007 (UTC)

First off, who cares? Wow, some people invest for one reason and others for another reason and still other's for a totally different reason. SO WHAT! I am trying to clean this article up and provide citations for everything and am largely the only person doing it. The less text there is to manage, the easier it is to provide citations for everything and the cleaner the article can be. Prestonp ( talk) 15:31, 29 December 2007 (UTC)

I feel that the different types of gold invesor do fit in with an encyclopedia entry called gold as an investment. However perhaps there is room to tidy the article up, but i would definitely keep this section in some form. What we could do without are some of the implicit opinions e.g. "However, some asset allocators and investment advisors are again advocating it." and I would like the article to provide stronger evidence of gold's low correlation with other asset classes. Although ( talk) 19:01, 29 December 2007 (UTC)

- Well you've got an entire graph of gold versus the Dow Jones. WHich other classes where you thinking of? Prestonp ( talk) 17:09, 30 December 2007 (UTC)

- Hi Prestonp, thanks for your clean up work. I contributed the 'Low or negative real interest rates' paragraph of the 'Factors influencing the gold price' section. Regarding citations I guess my original and perhaps best source is http://www.zealllc.com/2001/realgold.htm this is part one of a nine part series. Part 7, which is the top search result when googling for 'real interest rates and gold' is here http://www.zealllc.com/2004/realgold7.htm , but I like part 1 the best. I'm ok with including this as a citation if no one objects.

- I've added some citations now. I hope these are ok and comply with any/all wikipedia standards, if not please accept my apologies.

- BTW I'd like to comment on other asset classes, apart from equities (e.g. dow jones) they include cash (cash deposits in some currency), bonds (e.g. treasury securities like 2 year notes), real estate, collectibles, commodities and precious metals. If the money supply (as shown by M3, shadow stats) is increased quickly this new money has previously and may again flow unevenly into the asset classes causing a succession of economic bubbles. In Austrian economics this is called malinvestment and if not properly constrained leads to a crack up boom. The citations I've given indicate that based on traditional valuation metrics (e.g. P/E ratios) bubbles have already occurred in equities (dot-com boom), real estate (subprime) and bonds. ICouldBeWrong ( talk) 08 Feburary 2008 (UTC)

Happy New Year everyone! Let's discuss and tackle each of the review points outlined above in numerical order ... starting with #1 the Manual of Style violations. What should the lead for this page be? Personally, I'd like to see some tangible evidence that gold is better than any other monetary vehicle such as foreign currencies, other precious metals or other commodities. Should something like that be the basis for this page? ( InsideGold ( talk) 03:06, 4 January 2008 (UTC))

- Well, Gold has hit a high in all major currencies? Is that good enough a discussion or should there be something else? Prestonp ( talk) 05:56, 6 January 2008 (UTC)

- True, but is this a result of the US on the brink of a recession? We haven't seen gold take a run like this for any other major countries getting in trouble. If the USD is the major lynch-pin for gold, should that be our opening statement? InsideGold ( talk) 17:26, 7 January 2008 (UTC)

This seems the appropriate section to highlight this. A large amount of the gold.org links in the 'References' section have now changed due to a site upgrade at www.gold.org. Where possible, links have been redirected. If someone could message me then I will assist in locating the correct content within the website. Hdotnet ( talk)11:54, 27 March 2008 (UTC)

This article seems a little out of date now.

The price of gold has shot up and is now in a range above 850USD per ounce. It seems (although it is a prediction of course) that it is likely to stay above the 850 dollars an ounce.

Also i agree that oil should be mentioned as with the increase of the oil price, among with the weaker US dollar has contributed to the increase of gold which, I believe, is seen as a safe haven for many investors now.

Michael IFA ( talk) 09:03, 4 January 2008 (UTC)

- You can't say that gold will stay above any price. Hasn't it already been stated some of the factors that control the price of gold (political instability, forex rates, etc.)? Do we need to cite oil as being the factor (seems rather temporal)? That said, I do have some charts I've been playing with which show gold in other currencies ... I find it useful for seeing which countries are hedged against the USD or stand on their own merit. You can see the charts here: Metal by Currency (modified to suit of course) ... would they be useful? -- InsideGold ( talk) 17:51, 4 January 2008 (UTC)

We have to be careful of not giving OPINIONS about the price of gold or its relative merit. —Preceding unsigned comment added by Although ( talk • contribs) 01:56, 10 January 2008 (UTC)

what is the effect of price detemination of gold on the jewellers and jewellery market??? —Preceding unsigned comment added by 117.199.193.57 ( talk) 08:19, 18 March 2008 (UTC)

"Gold bullion" currently redirects to this page but this page doesn't ever really say what a gold bullion is —Preceding unsigned comment added by 69.55.20.103 ( talk) 03:44, 19 October 2008 (UTC)

See bullion, there is actually a link to there early on in this article if you didn't see it.-- Eloil ( talk) 22:39, 24 October 2008 (UTC)

I removed a number of external links that do not remotely meet WP:RS as reliable, independent, third-party sourcing. Many of the removed citations were one of several referencing the same facts; others were links to product pages on Amazon or commercial white pages. Flowanda | Talk 11:44, 26 November 2008 (UTC)

- the amazon links were books, so i put them back with book citations. — Chris Capoccia T⁄ C 14:52, 26 November 2008 (UTC)

- Thanks - checking all those references muddled my brain. Flowanda | Talk 19:19, 26 November 2008 (UTC)

I am looking to update this article. Does anyone have any suggestions for the structure of this article. I was thinking of something like this:

Introduction

Reason Investors Buy Gold (including 1.Investing in Gold as a Safe Haven and 2.Investing in Gold for Profit)

Methods of Investing in Gold

Investment Analysis (including 1.Fundamental Analysis and 2.Technical Analysis)

Gold Prices

References

See Also

External Links

How does everyone feel about his layout? I know that there are some major changes, but the article doesn't read very well in it's current state.

Notes:

"Gold versus stocks" and "Using leverage" should both be moved to the "Methods of Investing in Gold" article, although I don't think that this article should be separate from this one.

"Gold's value versus money supply" and "Bulls vs Bears" should be merged in the "reason Investors Buy Gold" section.

Please give me some feedback. I will start working on this in two weeks. Thanks everyone. Americanjoe1776 ( talk) 18:23, 14 January 2009 (UTC)

also, i will be sure the put in citations. if you could, please make sure that i cited everything that needs to be once the article is updated. thanks. Americanjoe1776 ( talk) 18:27, 14 January 2009 (UTC)

In my opinion, this article would need quite a lot of work to achieve GA. There seems to be too strong a bias in favour of investing in gold. The fact that so many of the assertions are supported by citations from bullion dealing, spread betting, gold share pumping etc sites, is a real problem. These would really have to be replaced by clearly neutral sources (e.g., such as the one I did for the BoE bullion sales). The contrary point of view needs to be stated [such as the one that says that the price of gold is constant in real terms in the long term - it keeps pace with inflation. It advances (or catches up) in difficult times and returns to the mean in stable times. I have no idea where I read that, it's not my subject!] Just my two micrograms worth. -- John Maynard Friedman ( talk) 00:59, 21 January 2009 (UTC)

This article melts away fast. It could be good for the overall quality, but some valid material is being removed as well. As indicated in the WP:RS significant-minority views should be covered by articles. I refer to the mention of

- The Gold Anti-Trust Action Committee

- The money supply adjusted price charts like the one on the right

What sources do editors removing consider reliable enough, and why do the sources of these institutions are not considered reliable themselves? Emilfaro ( talk) 16:47, 30 January 2009 (UTC)

- Please provide a third-party reference that demonstates the notability of gata, and mises.org is not a reliable source for anything other than their own views,

Hipocrite (

talk) 18:24, 2 February 2009 (UTC)

- Can from your point of view

Reuters,

mentioning

GATA qualify it as an existing organization? Can the references in the

Ludwig von Mises Institute article prove the same for mises.org? If these organizations exist and have their own opinion would it not violate

WP:NPOV not mentioning them from your standpoint?

Emilfaro (

talk) 03:08, 4 February 2009 (UTC)

- That's not a reuters mention, it's a press release. Mieses.org is not a reliable source for facts about anything other than their own viewpoints - you use them as a source for something about money supplies, which they are not reliable about.

Hipocrite (

talk) 11:36, 4 February 2009 (UTC)

- Please, 1. clarify, what do you mean by a press release: Reuters do not publish every press release, that exist in the World, but only the most notable ones. This "press release" confirms, that GATA exists, doesn't it? If Reuters finds GATA worth mentioning, why Wikipedia should not? 2. True Money Supply (TMS) is indeed a measure of

money supply (

inflation) used by

Austrian School of Economics, and can be considered their "own viewpoint". What is important it is not my viewpoint, thus not

WP:OR. But this is a significant-minority (Austrian School) viewpoint, so why should not it be represented? Your objections are not clearly understood. You say: they "are not reliable" about "money supplies", the question is why? Do you consider only government data to be reliable?

Emilfaro (

talk) 18:26, 4 February 2009 (UTC)

- Reuters did not publish that press release. Buisness Wire published it. Reuters captured it on an automated news feed. It does not establish the notability of GATA. TMS is not a measure of anything. It is a non-relevent number that is used only by one very-tiny heterodox school of economics. While mentioning TMS incredibly briefly in an article about money supply, or having a fuller discussion on it in an article about Austrian Economics might be appropriate, it has nothing to do with Gold as an Investment. I consider only data from Reliable Sources to be reliable. Mieses.org is not a reliable source for Gold as an Investment. Hipocrite ( talk) 18:50, 4 February 2009 (UTC)

- Please, 1. clarify, what do you mean by a press release: Reuters do not publish every press release, that exist in the World, but only the most notable ones. This "press release" confirms, that GATA exists, doesn't it? If Reuters finds GATA worth mentioning, why Wikipedia should not? 2. True Money Supply (TMS) is indeed a measure of

money supply (

inflation) used by

Austrian School of Economics, and can be considered their "own viewpoint". What is important it is not my viewpoint, thus not

WP:OR. But this is a significant-minority (Austrian School) viewpoint, so why should not it be represented? Your objections are not clearly understood. You say: they "are not reliable" about "money supplies", the question is why? Do you consider only government data to be reliable?

Emilfaro (

talk) 18:26, 4 February 2009 (UTC)

- That's not a reuters mention, it's a press release. Mieses.org is not a reliable source for facts about anything other than their own viewpoints - you use them as a source for something about money supplies, which they are not reliable about.

Hipocrite (

talk) 11:36, 4 February 2009 (UTC)

- Can from your point of view

Reuters,

mentioning

GATA qualify it as an existing organization? Can the references in the

Ludwig von Mises Institute article prove the same for mises.org? If these organizations exist and have their own opinion would it not violate

WP:NPOV not mentioning them from your standpoint?

Emilfaro (

talk) 03:08, 4 February 2009 (UTC)

I was told that one should not put links up to websites that have google ads or are monetized websites. (e.g I am not allowed to put my website up as it has google ads on.

So how come http://www.goldbullionprices.org/ is listed under the links? Bullion vault is a gold seller and also has heaps of google ads next to a couple of charts.

http://goldprice.org is more a informational site and sells nothing although has some google ads on. I bet that is not allowed.

210.15.236.131 ( talk) 02:58, 31 January 2009 (UTC) Michael

- Two wrongs don't make a right. These are linkspam in their own right (with or without the google ads, and should go. Which I'll now do. --

John Maynard Friedman (

talk) 00:35, 2 February 2009 (UTC)

- No, I can't, because they provide citations, they are not just external links. But, as I've said already, I believe that citing sites that are clearly prosletysing for one point of view is a conflict of interest and seriously undermines the credibility of the article in particular and Wikipedia in general. -- John Maynard Friedman ( talk) 00:41, 2 February 2009 (UTC)

- The rules for external links are different from the rules for citations. If it is in the external links section but is really providing a citation, it should be moved to the appropriate section. -- Gerry Ashton ( talk) 19:54, 5 February 2009 (UTC)

- It was [technically] correctly used as an inline citation so can't be deleted without further ado. -- John Maynard Friedman ( talk) 21:22, 8 February 2009 (UTC)

- Google ads do not automatically disqualify links but many dodgy sites use Google ads, hence the misbelief that we have a rule against Google ads. Nobody raises any concerns about linking to the New York Times, etc, even though those sites also have ads.

- You may not link to your own site.

- Citations are not sacrosanct. We get a lot of citation-spam and hopefully it gets deleted. You need to make a editorial judgement call -- either to leave the text that it's supporting, adding a {{ fact}} tag, or else delete the text.

- Our rules for external links and citations are different -- our requirements for citations (article sources) are higher. We want as authoritative and respected a site as possible. So if you're citing historical prices, I'd use the LBMA data from http://www.lbma.org.uk/stats/goldfixg and I wouldn't use either goldprice.org or goldbullionprices.org.

- If you see spam, please reverse, issue a polite warning and, if it recurs, report it at WikiProject Spam and one of the spam specialists will investigate and monitor it further. -- A. B. ( talk • contribs) 02:40, 9 February 2009 (UTC)

I added a section about the government's policy for money supply fluctuations and it was removed. The reason why I added the section is that the investment-aspect of gold has been significantly altered by quatitative easing by the Federal Reserve. While new to Wikipedia, I have much knowledge regarding the gold mining and gold investment industry. I have been an analysts for the past 15 years for a major metals and minerals fund. Let me know if I should continue modifying this article as it is badly out-of-date.

Thanks, Joel

Jbg.gold ( talk) 15:11, 14 August 2009 (UTC)Joel 14 August 2009

What is the point of the image of the Yugoslavia dinar? While hyperinflation does affect the nominal value of gold, I think the image is mostly unrelated. Rm999 ( talk) 00:36, 22 September 2009 (UTC)

I tried to add the 'real' (i.e, 2008 $) price to the table, but I've got an anomaly for 1985. I'm parking the work in progress here until I can find out what is wrong.

| Year | Gold, USD/ oz [1] | Silver, USD/ oz [2] | DJIA, USD [3] | World GDP, USD tn [4] | US Debt, USD bn [5] | Trade Weighted US dollar Index [6] | Equivalent price in 2008 $ [7] |

|---|---|---|---|---|---|---|---|

| 1970 | 37.4 | 1.6 | 838.9 | 3.3 | 370.1 | ? | 207.4 |

| 1975 | 140.3 | 4.2 | 852.4 | 6.4 | 533.2 | 33.0442 | 561.4 |

| 1980 | 589.5 | 15.5 | 964.0 | 11.8 | 907.7 | 35.6922 | 1540.4 |

| 1985 | 327.0 | 5.8 | 1,546.7 | 13.0 | 1,823.1 | 68.2042 | 654.6 |

| 1990 | 353.4 | 4.2 | 2,633.7 | 22.2 | 3,233.3 | 73.2249 | 582.4 |

| 1995 | 369.6 | 5.1 | 5,117.1 | 29.8 | 4,974.0 | 90.3097 | 522.2 |

| 2000 | 272.7 | 4.6 | 10,786.9 | 31.9 | 5,662.2 | 118.6013 | 340.9 |

| 2005 | 513.0 | 8.8 | 10,717.5 | 45.1 | 8,170.4 | 111.5580 | 565.5 |

| 2008 | 1065.0 | 10.8 | 8,776.4 | 54.6 | 10,699.8 | 96.0884 | 865 |

suggestions as to what the problem is would be welcome. -- John Maynard Friedman ( talk) 12:42, 7 October 2009 (UTC)

- Or was inflation really that insane? -- John Maynard Friedman ( talk) 12:43, 7 October 2009 (UTC)

- Unless each column in the graph is inflation adjusted (and, please don't use such a limited deflator as the United States' (!) Consumer Price Index), it doesn't make sense to adjust any one column. More important, if all of them are unadjusted, there is a straight comparison available, without distortion.

DOR (HK) (

talk) 08:29, 8 October 2009 (UTC)

- But it is not a straight comparison when the purchasing power of a 1985 dollar was much grater than a 2009 dollar. Chalk and cheese comparison. (And wholesale gold is priced in US, at least for the present). -- John Maynard Friedman ( talk) 17:38, 10 October 2009 (UTC)

- With inflation nothing is really mentioned for those who buy gold how much it cost to store gold and sell it for a profit back? Clack Howard thinks buying gold is a ripoff when you add the inflation cost and more http://www.jsonline.com/blogs/business/40223467.html —Preceding unsigned comment added by 24.205.229.251 ( talk) 22:27, 18 March 2010 (UTC)

This whole table looks a bit US focussed to me. Perhaps use a world index rather than DJIA or at least a more broad based US index. A world index would be better. US debt seems rather arbitrary. Why not list any other country's debt? Real prices in other currencies will show different patterns - based on the ppp exchange rate of the USD. The whole exercise seems slightly ill conceived from a non-US perspective. Stephen B Streater ( talk) 22:59, 19 March 2010 (UTC)

- I think listing other countries exchange rate would be a good index table than this one. —Preceding unsigned comment added by 24.205.229.251 ( talk) 01:02, 20 March 2010 (UTC)

References

- ^ LBMA Gold Fixings yearly close

- ^ LBMA Silver Fixings yearly close

- ^ Dow Jones Industrial Average yearly close

- ^ The UN Statistics Division world GDP

- ^ Historical Debt Outstanding - Annual 1950 - 1999, The Debt to the Penny and Who Holds It

- ^ Nominal broad dollar index US Federal Reserve. Base date for index (100.0000) was Jan 1997. Index value shown as at June of the relevant year.]

- ^ 1634–1699: McCusker, J. J. (1997). How Much Is That in Real Money? A Historical Price Index for Use as a Deflator of Money Values in the Economy of the United States: Addenda et Corrigenda (PDF). American Antiquarian Society. 1700–1799: McCusker, J. J. (1992). How Much Is That in Real Money? A Historical Price Index for Use as a Deflator of Money Values in the Economy of the United States (PDF). American Antiquarian Society. 1800–present: Federal Reserve Bank of Minneapolis. "Consumer Price Index (estimate) 1800–". Retrieved February 29, 2024.

I thought an Olympic size swimming pool was 50 metres long, therefore 20.2m is only just over 40% of its length.

This is under "Factors influencing the gold price" Jamescourtenay ( talk) 21:25, 28 November 2009 (UTC)

- Clearly wrong. I deleted the statement. It should have read "enough to fill 2 Olympic size pools", but this is not relevant or is overemphasis in the context. Kbrose ( talk) 22:52, 28 November 2009 (UTC)

In the "Using leverage" section it states:

Bullish investors may choose to leverage their position by borrowing money against their existing assets and then purchasing gold on account with the loaned funds. This technique is referred to as a carry trade. [Emphasis mine]

I believe this is incorrect and should be changed. My understanding is that a Carry Trade, specifically, refers to currency trading where the position is carried forward overnight and the interest rate differential between the two currencies (positive or negative) is added / subtracted to your account. A carry, in a broader sense, is the appreciation / depreciation of an asset obtained just by holding it. That is, what is earned if the asset's price remains the same.

Using leverage has nothing to do with a carry trade – a carry trade can use leverage or not. Additionally, I would think that a carry trade on gold is illogical, as gold doesn't give any "returns" (think interest / dividends). Profits or losses come solely from the increase / decrease in the asset's price. It is a speculative investment.

Happy to be corrected though…

Tennii ( talk) 00:06, 21 February 2010 (UTC)

- I deleted the statement. nirvana2013 ( talk) 20:44, 25 February 2010 (UTC)

Today's opinions as to the way the gold price might go in future are not suitable for an encyclopaedia - they are more suitable for a news outlet like Wikinews. The article should concentrate on things which have actually happened and their interest level has withstood the test of time. Consider looking back at this article in a couple of year's time. The future predictions will then refer to the past, and may have proved to be wildly inaccurate. Much better to report now what happened in the last few years, as this will still be accurate going forwards. Stephen B Streater ( talk) 15:21, 18 May 2010 (UTC)

- Absolutely. Such statements are in direct contravention of

WP:CRYSTAL and should be deleted. Even if well sourced, Wikipedia is a not a ticker tape. --

John Maynard Friedman (

talk) 22:38, 18 May 2010 (UTC)

- This depends. When the opinions of one person is in one direction they are conserved. When a

matization ( clarification or qualification) is added (i.e. that we are in a gold bubble - a type of

investment bubble, similar to the

subprime

bubble some year ago and with some of the same players), then both opinions are deleted. Neutrality indicates that opinions that we are in a gold bubble must also included, near to the opinions that gold is a "good" investment.--

Nopetro (

talk) 06:10, 19 May 2010 (UTC)

- I agree that technically reporting what someone has said about the future is not a forward looking statement, which is why I didn't cut the text but came here instead. But then for balance, we need to expand the article to include GATA claims of gold price suppression and numerous other opinions. Given how few people actually own gold, and the troubles fiat currencies are in, it seems that the current bull market has a lot further to run before we are enter bubble territory. Stephen B Streater ( talk) 08:12, 19 May 2010 (UTC)

- This depends. When the opinions of one person is in one direction they are conserved. When a

matization ( clarification or qualification) is added (i.e. that we are in a gold bubble - a type of

investment bubble, similar to the

subprime

bubble some year ago and with some of the same players), then both opinions are deleted. Neutrality indicates that opinions that we are in a gold bubble must also included, near to the opinions that gold is a "good" investment.--

Nopetro (

talk) 06:10, 19 May 2010 (UTC)

the last sentence reads:

- "Leading into 2010, Google had doubled off that (100%), whereas gold had risen 40%."

makes no sense. Does anyone understand? Is Google doing better than Gold? Green Cardamom ( talk) 06:18, 29 June 2010 (UTC)

- I believe that it is an incoherent way of saying that the share price of Google doubled in the course of the interval ending Dec 09 (starting ?) whereas the price of gold increased by 40% in the same period. A more logical comparison would be with the DOW or FTSE but the citation is for Google. -- John Maynard Friedman ( talk) 22:31, 29 June 2010 (UTC)

I added a link to kitco.com that promptly got booted. My question: If I was searching wiki for data on gold prices (as I was a few years ago), I would like a link to some place that had current prices...I am unfamiliar with this enmity toward adding links or policies on it, but could we find a site with current prices that we could link here? —Preceding unsigned comment added by 74.211.68.219 ( talk) 21:11, 30 October 2010 (UTC)

- We don't allow links to commercial sites. Kitco.com sells gold online from their site. I've added goldprice.org, where you can get the price and lots of articles, but no store or sales. Yworo ( talk) 21:20, 30 October 2010 (UTC)

Hi,

I would like to submit a video for inclusion in the article. It is titled Goldnomics and has received widespread praise for its presentation of gold relative to other values.

The link is http://www.youtube.com/watch?v=-HaqwFJj4ZY

I would appreciate your thoughts regarding its inclusion and then the section best suited for it. — Preceding unsigned comment added by GoldCore ( talk • contribs) 17:26, 23 February 2011 (UTC)

I received this 'new message' when logged on:

"...one or more of the external links you added do not comply with our guidelines for external links and have been removed...Thank you. futuresoption.com is not a reliable source. Yworo (talk) 23:53, 24 February 2011 (UTC) Retrieved from " http://en.wikipedia.org/wiki/User_talk:QQujt" Hidden categories: User talk pages with Uw-spam1 notices"

Can anyone tell me what was it about the external link that did not comply as I see the format used in other areas of Wikipedia.

Who or by what criteria could have been used to arrive at the assertion that futuresoption.com is not a reliable source? It is a very well established site.

I added (under 'Mining Companies'): "The discovery risks are joined by rises in development, extraction and purification costs, and also changes in monetary exchange rates."

QQujt ( talk) 02:02, 5 March 2011 (UTC)

- Answered at Talk:Peak copper. Yworo ( talk) 16:18, 5 March 2011 (UTC)

The introduction seems very subjective. The first sentence, if it belongs anywhere in the article, should be prefaced with 'Some suggest' and buried in a section about economists' predictions. ypnypn ( talk) 02:38, 8 November 2011 (UTC)

- It looks like the first few sentences of the article were deleted on 17 October; not clear why. I've put them back. The intro's still not great, but it's better. (And you should see what that 'behaves more like a currency than a commodity' bit looked like this time last year...) Chronodm ( talk) 19:33, 9 November 2011 (UTC)

The claim made in the article that "...a dollar invested in stocks that same year would be worth more than half a million dollars..." is a perfect example of Survivorship_bias. Indexes are both selective and dynamic. Bad performers are continuously removed and replaced with better ones. Instead, the money of the unfortunate investors is not replaced with shares of the newcomers, it's just lost. Actually, if you had invested 1 dollar in 1801 in the stock markets you'd have zero today, but not so with gold. -- 145.64.134.242 ( talk) 16:34, 11 January 2013 (UTC)

- 145.64.134.242, the premise of your statement is factually inaccurate because it is always possible to buy positions that directly match the indexes, either indirectly by means of a passively managed index fund, or directly by actually buying positions in the individual stocks. Moreover, given that the economy of the world and the US has by any measure grown most years since 1801, at most times substantially faster than gold prices. Theoretically, if you were somehow able to invest $1 in every company on the planet, you would have made 40100% on your investment. Gold would have made you ~7500% on your investment. Total inflation in the US since then has been ~1500%, so if you lived in the US you would actually have experienced more like a 2500% increase in purchasing power versus a roughly 500% increase in the same if you had invested in gold, but you get my point. So I assume the point of the quoted statement was to highlight the opportunity cost of waiting for the sky to fall, which is a perfectly legitimate thing to highlight in an article about investing in gold. Quodfui ( talk) 21:41, 23 November 2013 (UTC)

- Out of curiosity... did any public listed stock exist after an unbroken period of 197 years (1801–1998)? Lettonica ( talk) 11:06, 2 October 2013 (UTC)

- Yes. Consider the Hudson's Bay Company, which was founded in 1670 as a Joint Stock Company. Still going strong. So is J.P. Morgan Chase, which has its origins in The Manhattan Company, which has been issuing stock since 1799 [1]. See List of Oldest Companies for more (some haven't been listed for their entire histories, but many have very, very long histories as publicly-traded stocks). Quodfui ( talk) 22:08, 23 November 2013 (UTC)

With respect, I still believe that having the quotation "...a dollar invested in stocks that same year would be worth more than half a million dollars..." without proper context is improper. Real people buy specific shares, not a balanced percentage of shares in every listed company, and not necessarily in the US. A dollar invested in 1801 might have turned to a million or to zero, depending what you actually bought with it.

Not to put too fine a point on it, the above mentioned sentence might lead someone to believe that a dollar invested in ANY stocks in 1801 would be worth more than half a million dollars, which is not correct.

— Preceding

unsigned comment added by

2.36.89.142 (

talk) 17:08, 2 January 2022 (UTC)

Hello fellow Wikipedians,

I have just modified 8 external links on Gold as an investment. Please take a moment to review my edit. If you have any questions, or need the bot to ignore the links, or the page altogether, please visit this simple FaQ for additional information. I made the following changes:

- Added archive http://web.archive.org/web/20100916033528/http://www.gold.org:80/deliver.php?file=/value/stats/statistics/pdf/Supply_Demand.pdf to http://www.gold.org/deliver.php?file=/value/stats/statistics/pdf/Supply_Demand.pdf

- Added archive http://web.archive.org/web/20110410223952/http://www.goldalert.com:80/gold-price-hovers-at-1460-as-ecb-hikes-rates-2/ to http://www.goldalert.com/gold-price-hovers-at-1460-as-ecb-hikes-rates-2/

- Added archive http://web.archive.org/web/20110410224233/http://www.goldalert.com:80/gold-stocks-rally-hui-hits-all-time-high/ to http://www.goldalert.com/gold-stocks-rally-hui-hits-all-time-high/

- Added archive http://web.archive.org/web/20110122124718/http://www.gold.org:80/investment/why_how_and_where/why_invest/demand_and_supply/ to http://www.gold.org/investment/why_how_and_where/why_invest/demand_and_supply/

- Added archive http://web.archive.org/web/20101205182917/http://www.gold.org/world_of_gold/market_intelligence/gold_demand/gold_demand_trends/ to http://www.gold.org/world_of_gold/market_intelligence/gold_demand/gold_demand_trends/

- Added archive http://web.archive.org/web/20100705095149/http://www.lbma.org.uk:80/docs/gdlvarious/GD%20Rules%2020100511.pdf to http://www.lbma.org.uk/docs/gdlvarious/GD%20Rules%2020100511.pdf

- Added archive http://web.archive.org/web/20100701170920/http://kingworldnews.com:80/kingworldnews/Broadcast/Entries/2010/4/7_Andrew_Maguire_&_Adrian_Douglas.html to http://www.kingworldnews.com/kingworldnews/Broadcast/Entries/2010/4/7_Andrew_Maguire_%26_Adrian_Douglas.html

- Added archive http://web.archive.org/web/20130725210441/http://vietnamembassy.org.au/Economics.htm to http://vietnamembassy.org.au/Economics.htm

When you have finished reviewing my changes, please set the checked parameter below to true or failed to let others know (documentation at {{

Sourcecheck}}).

This message was posted before February 2018.

After February 2018, "External links modified" talk page sections are no longer generated or monitored by InternetArchiveBot. No special action is required regarding these talk page notices, other than

regular verification using the archive tool instructions below. Editors

have permission to delete these "External links modified" talk page sections if they want to de-clutter talk pages, but see the

RfC before doing mass systematic removals. This message is updated dynamically through the template {{

source check}} (last update: 18 January 2022).

- If you have discovered URLs which were erroneously considered dead by the bot, you can report them with this tool.

- If you found an error with any archives or the URLs themselves, you can fix them with this tool.

Cheers.— cyberbot II Talk to my owner:Online 15:59, 15 April 2016 (UTC)

" Gold trade" currently redirects here, but it seems like information on the historic gold trade is missing from this article.-- Prisencolin ( talk) 01:40, 12 February 2017 (UTC)

This

edit request has been answered. Set the |answered= or |ans= parameter to no to reactivate your request. |

Alvaro Friedenzohn ( talk) 09:23, 26 June 2017 (UTC)

fixed broken link with authority site

Changed the link from "gold price usa" from dailygoldpro.com ( a broken link) to http://www.goldprice.com the biggest authority in gold prices Alvaro Friedenzohn ( talk) 09:30, 26 June 2017 (UTC)

- Even if the external link in the reference is currently a dead link, that is still the source of the information. A dead link is preferably fixed or recovered from an archiving source, rather than being replaced with a different one. Deli nk ( talk) 11:35, 26 June 2017 (UTC)

This

edit request has been answered. Set the |answered= or |ans= parameter to no to reactivate your request. |

Shepherda ( talk) 14:10, 5 July 2017 (UTC)

Not done: it's not clear what changes you want to be made. Please mention the specific changes in a "change X to Y" format.

jd22292 (Jalen D. Folf) (

talk) 14:59, 5 July 2017 (UTC)

Not done: it's not clear what changes you want to be made. Please mention the specific changes in a "change X to Y" format.

jd22292 (Jalen D. Folf) (

talk) 14:59, 5 July 2017 (UTC)

Hello fellow Wikipedians,

I have just modified 6 external links on Gold as an investment. Please take a moment to review my edit. If you have any questions, or need the bot to ignore the links, or the page altogether, please visit this simple FaQ for additional information. I made the following changes:

- Added archive https://web.archive.org/web/20140111180034/http://www.dailygoldpro.com/ to http://www.dailygoldpro.com/

- Added archive https://web.archive.org/web/20160420230114/http://webarchiveproject.org/520811/ to http://webarchiveproject.org/520811/

- Corrected formatting/usage for http://www.gold.org/deliver.php?file=%2Fvalue%2Fstats%2Fstatistics%2Fpdf%2FSupply_Demand.pdf

- Added archive https://web.archive.org/web/20070706155619/http://gold.seekingalpha.com/article/16299 to http://gold.seekingalpha.com/article/16299

- Corrected formatting/usage for http://www.kingworldnews.com/kingworldnews/Broadcast/Entries/2010/4/7_Andrew_Maguire_%26_Adrian_Douglas.html

- Added archive https://web.archive.org/web/20091231025230/http://www.onwallstreet.com/ows_issues/2010_1/many-ways-to-gain-exposure-to-gold-2665039-1.html to http://www.onwallstreet.com/ows_issues/2010_1/many-ways-to-gain-exposure-to-gold-2665039-1.html

When you have finished reviewing my changes, you may follow the instructions on the template below to fix any issues with the URLs.

This message was posted before February 2018.

After February 2018, "External links modified" talk page sections are no longer generated or monitored by InternetArchiveBot. No special action is required regarding these talk page notices, other than

regular verification using the archive tool instructions below. Editors

have permission to delete these "External links modified" talk page sections if they want to de-clutter talk pages, but see the

RfC before doing mass systematic removals. This message is updated dynamically through the template {{

source check}} (last update: 18 January 2022).

- If you have discovered URLs which were erroneously considered dead by the bot, you can report them with this tool.

- If you found an error with any archives or the URLs themselves, you can fix them with this tool.

Cheers.— InternetArchiveBot ( Report bug) 04:05, 17 September 2017 (UTC)

The stated reason for the template placement is as follows:

- seems to deal excessively with modern gold trade, ignoring long history of gold trade

The article is not dealing with gold trade, but with gold as an investment. Considering that throughout most of history gold has been used for payment and as store of value, investing in gold in order to benefit from its appreciation relative to other types of assets is a relatively recent phenomenon. Therefore, I am removing the recentism template as it does not apply. PickledTriangle ( talk) 02:55, 31 May 2021 (UTC)

- Your logic seems reasonable so far as it goes but you need to allow a week for others to comment. I have reverted the removal for now, per WP:bold, revert, discuss.

- My immediate reaction is to refer back to a comment above: Gold trade redirects here and the article as it stands deals only with trade since the ending of the gold standard. The gold trade down the centuries has a very ugly history.

- I am not sure of the best way to resolve this. It may be that the only solution is a

WP:split? --

John Maynard Friedman (

talk) 07:58, 31 May 2021 (UTC)

- Gold trade and Gold trading redirect to

Gold#Cultural history as per

this discussion. I agree with the redirects, although we should probably define what "trading" in this context exactly means. I've nothing to add to my initial argument, but we could find ways to better integrate this article with other content dealing with investing.

PickledTriangle (

talk) 00:30, 1 June 2021 (UTC)

- Ok, I agree and withdraw my objection and will revert my reversion of your change. There was a problem in that 'gold trade' was redirecting just to Gold because someone changed a section title without adding an anchor for the old name. I have rectified that error. -- John Maynard Friedman ( talk) 23:53, 1 June 2021 (UTC)

- Gold trade and Gold trading redirect to

Gold#Cultural history as per

this discussion. I agree with the redirects, although we should probably define what "trading" in this context exactly means. I've nothing to add to my initial argument, but we could find ways to better integrate this article with other content dealing with investing.

PickledTriangle (

talk) 00:30, 1 June 2021 (UTC)

This

edit request has been answered. Set the |answered= or |ans= parameter to no to reactivate your request. |

There are some good reasons why you might not want to own it. Dealers charge premium prices and fees for gold coins. Gold has large liquidation spreads. It can be challenging to verify old or rare gold coins. Storing and insuring gold coins and bullion can be a hassle...and expensive. It's not clear how much price appreciation potential gold might have. Akshaya Gold ( talk) 08:34, 28 June 2021 (UTC)

This

edit request to

Gold_as_investment has been answered. Set the |answered= or |ans= parameter to no to reactivate your request. |

De-link gold certificate and gold certificates under the § Certificates section, and add {{ See also| Gold certificate (United States)}} under the subheading. 112.120.39.15 ( talk) 08:27, 8 January 2023 (UTC)

-

On hold Looking into it.

Lemonaka (

talk) 06:14, 9 January 2023 (UTC)

On hold Looking into it.

Lemonaka (

talk) 06:14, 9 January 2023 (UTC)  Done

Lemonaka (

talk) 22:36, 9 January 2023 (UTC)

Done

Lemonaka (

talk) 22:36, 9 January 2023 (UTC)

- Thanks. 112.120.39.15 ( talk) 08:03, 14 January 2023 (UTC)

This article does not discuss two viable gold investments: Gold Leases and Gold Bonds. These are ways for gold owners to earn a fixed income on their gold, paid in gold, which is also not mentioned. Should this be added to this page? Gold good ( talk) 22:06, 25 January 2023 (UTC)

This

edit request has been answered. Set the |answered= or |ans= parameter to no to reactivate your request. |

Gold Price

Throughout history, gold has been used as money and has served as a relative standard for currency equivalents specific to economic regions or countries. Many European countries implemented gold standards in the late 19th century. These standards were temporarily suspended during the financial crises involving World War I. [1] Following World War II, the Bretton Woods system pegged the United States dollar to gold at a rate of US$35 per troy ounce. This system remained in place until 1971 Nixon Shock, when the US unilaterally suspended the direct convertibility of the United States dollar to gold, transitioning to a fiat currency system. The last major currency to be separated from gold was the Swiss Franc in 2000. [2]

Since 1919, the most common benchmark for gold prices has been the London gold fixing, a twice-daily telephone meeting of representatives from five bullion-trading firms of the London bullion market. Additionally, gold is traded continuously worldwide based on the intra-day spot price, which is derived from over-the-counter gold-trading markets around the world ( code "XAU"). The table below displays the gold price versus various assets and key statistics at five-year intervals. [3]

Several factors, including supply and demand, geopolitical events, and global economic conditions, influence gold prices. Central banks and the International Monetary Fund play a significant role in the gold market. They hold large gold reserves that can affect the market when buying, selling, or leasing gold. Additionally, investors often turn to gold as a "safe-haven" asset during economic uncertainty, political instability, or high inflation. This increased demand for gold typically drives its price higher.

Investment vehicles such as gold-backed exchange-traded funds (ETFs) and futures contracts also affect gold prices. Gold-backed ETFs, which hold physical gold as an underlying asset, allow investors to gain exposure to gold without directly owning the metal. These ETFs track the price of gold and are traded on stock exchanges, influencing the demand for gold and, consequently, its price. On the other hand, gold futures contracts represent an agreement to buy or sell gold at a predetermined price on a specific future date. These contracts are traded on futures exchanges and can influence gold prices based on market expectations.

Gold mining and production also play a role in determining gold prices. An increase in gold production typically leads to a higher supply of gold in the market, which could lower prices. Conversely, a decrease in output or disruptions in the mining industry, such as strikes or geopolitical events affecting major gold producers, may result in reduced supply and higher gold prices.

Gold prices are often quoted in various currencies, with the US dollar being the most commonly used. However, gold prices can also be quoted in other currencies, such as the euro, British pound, or Japanese yen. As a result, currency exchange rate fluctuations can also impact gold prices.

In summary, gold prices are influenced by a complex interplay of factors, including supply and demand, geopolitical events, global economic conditions, central bank activities, investment vehicles, gold production, and currency exchange rates. Investors and analysts closely monitor these factors to predict potential price movements and make informed decisions about investing in or trading gold. https://www.linkedin.com/pulse/augusta-precious-metals-review-annette-lode-1f/ Johndocker ( talk) 09:21, 15 April 2023 (UTC)

Not done: it's not clear what changes you want to be made. Please mention the specific changes in a

"change X to Y" format and provide a

reliable source if appropriate. --

Pinchme123 (

talk) 03:21, 17 April 2023 (UTC)

Not done: it's not clear what changes you want to be made. Please mention the specific changes in a

"change X to Y" format and provide a

reliable source if appropriate. --

Pinchme123 (

talk) 03:21, 17 April 2023 (UTC)

References

- ^ "World War I - Battles, Facts, Videos & Pictures". History.com.

- ^ "Swiss Narrowly Vote to Drop Gold Standard". The New York Times. Associated Press. April 19, 1999. ISSN 0362-4331. Retrieved March 19, 2018.

- ^ "Gold Price USA". Daily Gold Pro. August 3, 2013. Archived from the original on January 11, 2014. Retrieved February 12, 2014.

For Wikiversity:A pictorial guide to asset price history, I plotted charts that could be interesting for Wikipedia:

The calculation code is in File:GoldPriceUSD.svg. Ideally, one would compare the charts with similar charts published elsewhere, but I do not know of such charts/their publication venue. -- Dan Polansky ( talk) 08:41, 29 March 2024 (UTC)