| This is the

talk page for discussing improvements to the

Carbon emission trading article. This is not a forum for general discussion of the article's subject. |

Article policies

|

| Find sources: Google ( books · news · scholar · free images · WP refs) · FENS · JSTOR · TWL |

|

Archives:

1Auto-archiving period: 1 year

|

|

| This article is rated B-class on Wikipedia's

content assessment scale. It is of interest to the following WikiProjects: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

|

| The

contentious topics procedure applies to this page. This page is related to

climate change, which has been

designated as a contentious topic. Editors who repeatedly or seriously fail to adhere to the purpose of Wikipedia, any expected standards of behaviour, or any normal editorial process may be blocked or restricted by an administrator. Editors are advised to familiarise themselves with the contentious topics procedures before editing this page. |

I think that this article is largely covered under cap and trade and is really just an article spawned off the same topic, no? - in other words, wouldn't it be better to have one complete, better organized article, than five or six related but in many ways redundant articles?

I'm having problems reviewing the edit just done : (Rescuing 73 sources and tagging 0 as dead.) #IABot (v2.0.9.5) The visual diff, https://en.wikipedia.org/?title=Carbon_emission_trading&diff=prev&oldid=1167803284 is problematic. It shows big edits in red that don't actually exist when I look at the source diff. The bot changes some cites from multi-line format to single-line, and does the reverse with others. I don't get it. The changes re. thecornerhouse.org.uk/summary don't make sense in either diff. But I can't see anything that's clearly worse, and some stuff that's better, so leaving as is. Weird. - RudolfoMD ( talk) 02:34, 30 July 2023 (UTC)

I've removed this example textblock from emissions trading. Would any of it fit here? It's not sourced though and reads more like a textbook so I doubt it.

Example

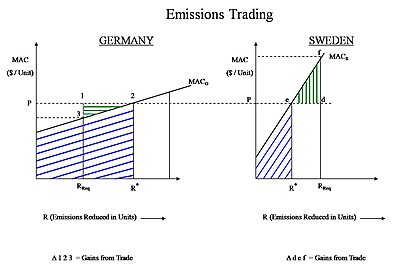

Emissions trading through Gains from Trade can be more beneficial for both the buyer and the seller than a simple emissions capping scheme.

Consider two European countries, such as Germany and Sweden. Each can either reduce all the required amount of emissions by itself or it can choose to buy or sell in the market.

Suppose Germany can abate its CO2 at a much cheaper cost than Sweden, i.e. MACS > MACG where the MAC curve of Sweden is steeper (higher slope) than that of Germany, and RReq is the total amount of emissions that need to be reduced by a country.

On the left side of the graph is the MAC curve for Germany. RReq is the amount of required reductions for Germany, but at RReq the MACG curve has not intersected the market emissions permit price of CO2 (market permit price = P = λ). Thus, given the market price of CO2 allowances, Germany has potential to profit if it abates more emissions than required.

On the right side is the MAC curve for Sweden. RReq is the amount of required reductions for Sweden, but the MACS curve already intersects the market price of CO2 permits before RReq has been reached. Thus, given the market price of CO2 permits, Sweden has potential to make a cost saving if it abates fewer emissions than required internally, and instead abates them elsewhere.

In this example, Sweden would abate emissions until its MACS intersects with P (at R*), but this would only reduce a fraction of Sweden's total required abatement.

After that it could buy emissions credits from Germany for the price P (per unit). The internal cost of Sweden's own abatement, combined with the permits it buys in the market from Germany, adds up to the total required reductions (RReq) for Sweden. Thus Sweden can make a saving from buying permits in the market (Δ d-e-f). This represents the "Gains from Trade", the amount of additional expense that Sweden would otherwise have to spend if it abated all of its required emissions by itself without trading.

Germany made a profit on its additional emissions abatement, above what was required: it met the regulations by abating all of the emissions that was required of it (RReq). Additionally, Germany sold its surplus permits to Sweden, and was paid P for every unit it abated, while spending less than P. Its total revenue is the area of the graph (RReq 1 2 R*), its total abatement cost is area (RReq 3 2 R*), and so its net benefit from selling emission permits is the area (Δ 1-2-3) i.e. Gains from Trade

The two R* (on both graphs) represent the efficient allocations that arise from trading.

- Germany: sold (R* - RReq) emission permits to Sweden at a unit price P.

- Sweden bought emission permits from Germany at a unit price P.

If the total cost for reducing a particular amount of emissions in the Command Control scenario is called X, then to reduce the same amount of combined pollution in Sweden and Germany, the total abatement cost would be less in the Emissions Trading scenario i.e. (X — Δ 123 - Δ def).

The example above applies not just at the national level, but also between two companies in different countries, or between two subsidiaries within the same company.

EMsmile (

talk) 12:18, 19 September 2023 (UTC)

(copied from talk page of emissions trading where I also wrote about it just now): I've just changed a whole bunch of redirects that were redirecting to this article to rather redirect to carbon emissions trading, for example anything to do with "cap and trade" or "emissions trading". My reasoning is that in current usage, emissions trading is mainly used for the carbon emissions trading and far less often for the other pollutants. So readers and potential editors are more likely to want to go to carbon emissions trading. You can also see in the pageviews how the views for emissions trading have gone done and those for carbon emissions trading have gone up, see here. EMsmile ( talk) 13:38, 19 September 2023 (UTC)

- B-Class Environment articles

- Low-importance Environment articles

- B-Class Climate change articles

- Top-importance Climate change articles

- WikiProject Climate change articles

- B-Class Economics articles

- Low-importance Economics articles

- WikiProject Economics articles

- B-Class Finance & Investment articles

- Low-importance Finance & Investment articles

- WikiProject Finance & Investment articles